Industries

Banking

Digital transformation has allowed banks to improve efficiency, reduce costs, expand services, and compete with new fintech companies. At the same time, it has enhanced the customer experience and the security of banking transactions

We create new business models, fostering innovation

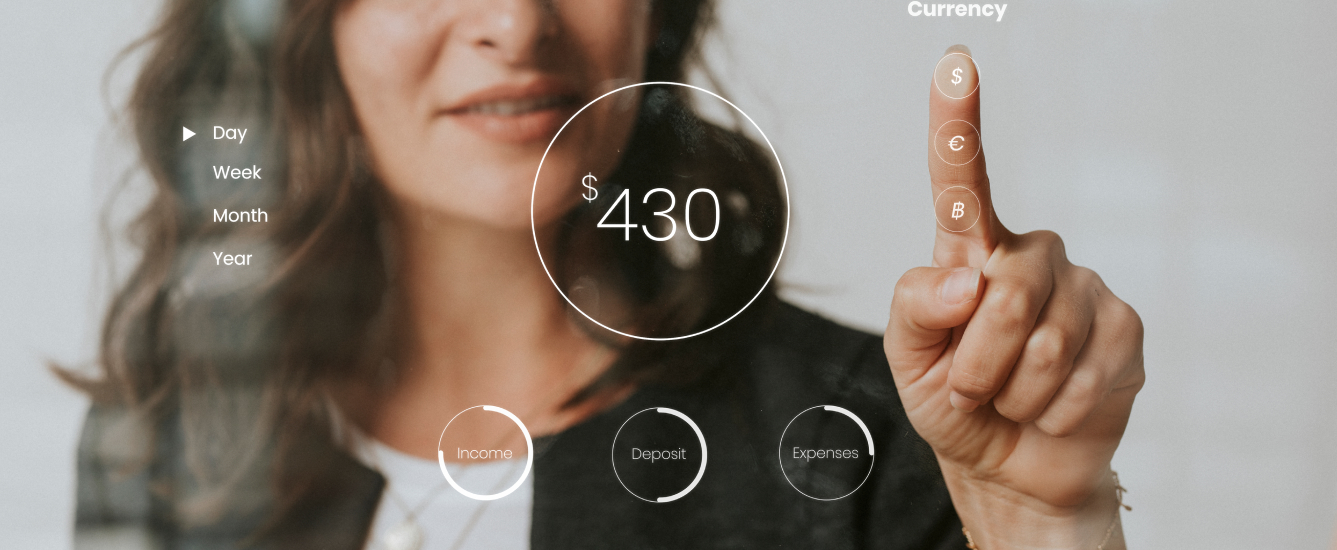

Improved Customer Experience

Digital transformation has enabled banks to enhance the customer experience by offering more personalized and accessible services. Customers can now conduct online banking transactions, open bank accounts, and apply for loans online, reducing the need to visit a physical bank branch.

Cost Reduction

The automation and digitalization of banking processes have enabled banks to reduce operational costs. For example, the implementation of chatbots and virtual assistants has allowed banks to serve customers more efficiently and reduce the need for personnel in the bank branch.

Enhanced Security

Banks have improved the security of their systems and transactions through the implementation of advanced security technologies, such as biometric authentication and encryption. In addition, banks have enhanced fraud detection and prevention through advanced data analysis and artificial intelligence.

[Data]

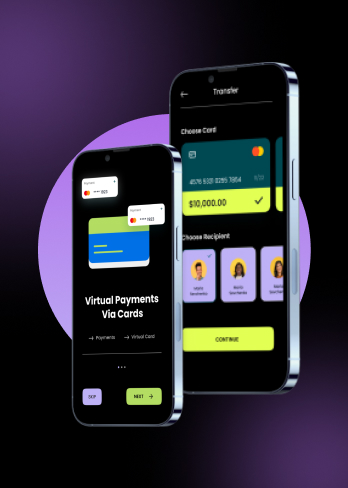

Expansion of Banking Services

Digital transformation has enabled banks to expand their services, offering innovative and more accessible financial products and services. For example, some banks have developed mobile applications that allow customers to invest in stocks and cryptocurrencies.

Competition with New Fintech Companies

Fintech companies have emerged as new competitors for traditional banks, leveraging technology to offer innovative financial services. Banks are responding to this competition by integrating fintech technologies into their own services and forming partnerships with these companies to offer complementary services.